It’s Time to Live a Stress-Free Financial Life

Your goal is to live a stress-free financial life. That is the whole point of having money.

The Craziest Thing Since 1999

There were a lot of sad stories after the dot-com crash... after the housing crash. Don’t be one of the people with a sad story after the next crash.

The House Determines Everything

Your financial health is less about discretionary consumption than you think. If you really want to move the needle, you need to control your fixed monthly costs.

Max Out Your IRA with $17 a Day

You may find it hard to believe what the average person spends in a day: $67.

This is just discretionary expenses. It doesn’t include fixed costs like your mortgage or utilities.

Of course, this was before COVID-19, when you could still go where you wanted, when you wanted.

I have an office in downtown Myrtle Beach (which I recently returned to). So before the shutdown I commuted every day and spent about $3/day on gas. I also spent $3 on an iced coffee at Dunkin’ Donuts, which I don’t consider optional.

For lunch, some days I spent $10 at Chipotle. Other days, $20 at a sit-down restaurant. So about $15 a day on lunch, on average. Then I would grab dinner before heading to the radio station for the show—another $25 or so per day.

Most days, that was pretty much it: $46 a day.

When you go through this exercise yourself—which I encourage you to do—you also want to tally up the stuff you buy on Amazon. Maybe it’s steak knives, a new bathmat, or Adirondack chairs for the front porch.

Then you’ve got your subscriptions—Netflix, Hulu, Amazon Prime. And maybe you buy a hot dog every time you hit Costco. Or you’re prone to impulse purchases and occasionally walk into GNC and drop $200 on vitamins.

Factor all that in, and it’s easy to see how quickly you could top $67 a day, which translates to $2,010 a month, or about $24,000 a year.

That’s a lot of money, and we should ALL make it a goal to spend less than $67 on optional stuff. This is doable, as many of you have recently discovered...

Some Great News

Over the past two months, the coronavirus has upended everyone’s routines. We’re not going out to dinner, grabbing cocktails with friends, or wandering through Nordstrom and dropping $75 on a shirt—though that’s starting to pick up again in some parts of the country.

For the most part, people are eating at home. They’re spending money on groceries and Netflix, but not much else.

Really, the shutdown has forced us to change our daily spending habits for the better. In March, the US personal savings rate shot up to 13%, the highest it’s been in 39 years.

This is great news: People do know how to save.

Say you were spending the $67 average before, and you cut that back to $40 a day. This gives you an extra $27 a day to play around with. That’s about $800 a month you could spend elsewhere, or use to pay off debt and bolster your savings. All without taking extreme austerity measures.

Retirement Within Reach

Let’s talk about the savings component.

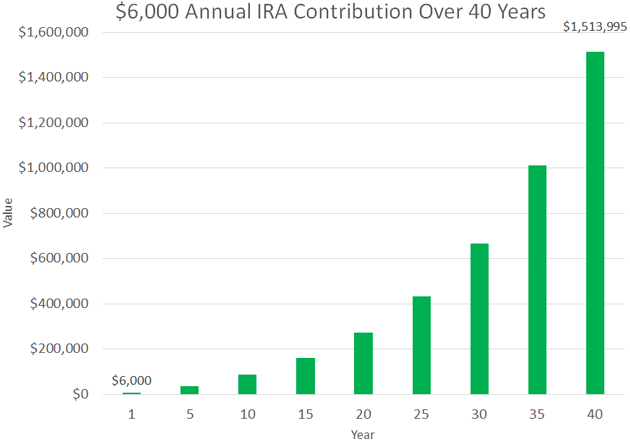

Say you want to save $500 a month, which is only about $17 a day. $500 a month comes to $6,000 a year, which is all you need to max out an IRA.

That's it. That's your retirement.

Bonus: You’ll also lower your taxes, since contributions to a traditional IRA are tax deductible. I dig into how this all works in my special report, Saving and Investing for the Retirement You Want, and I encourage you to download a copy if you’re serious about retirement.

Look, if you save $6,000 a year for 40 years, which is very doable, that's $240,000 before any investment returns. Factor in an average annual return of 7.9%—the average annual return over the last 40 years for a portfolio of 50% stocks and 50% bonds—and you’re looking at $1,513,995.

That’s a healthy retirement account, and you don't even need to get rid of the coffee. In fact, you need the coffee.

Basically, you just have to make lunch at home every day, even on the weekends. There’s your $17 a day, which is all you need for the maximum annual contribution to your IRA. Simple as that.

Simple, yet only around 36% of US households have an IRA. This is unfortunate. Because retirement is well within reach for more people.

We spend a lot of time talking about the big choices here at Jared Dillian Money: the house, the car, the student loans. But sometimes you only have to make small-ish changes to your daily habits to put yourself in a radically better position to retire comfortably when you’re ready.

Sometimes, it’s as simple as a homemade sandwich.

Jared Dillian

|

The Crazy Thing About Taxes

Personal finance is mostly about the big stuff, including taxes. Yet no one seems to know what their tax rate is, which is crazy! Don’t be one of these people.

Don’t “Snowball”—This Is How You Pay Off Debt

There’s some bad advice out there about paying off debt. Jared shows you the best way to eliminate debt for good. This is how you get your financial freedom back.

‹ First < 36 37 38 39 40 > Last ›